CPG Study Reveals Shocking Discovery About Customer Journey in 2023

From search to influencers, TikTok to Instagram, Amazon to mom-and-pop shops, CPG customers have never before had as many ways to discover and purchase day-to-day essentials as they do in 2023, and marketers have never had more potential touchpoints to use in influencing those purchases.

But what are the most effective channels for winning customers and building market share, and how does that vary by product category and age group?

To answer these and other key questions for CPG marketers, Tinuiti surveyed more than 3,000 US adults between February 16, 2023 and February 23, 2023 across three unique surveys designed to dive deep into beauty, food and beverage, and over-the-counter (OTC) health product consumption habits. The key takeaways from these surveys are divided into three category-specific tracks, and a cross-category track combines insights from all three surveys for your exploration.

Here’s a sneak peek at some of the biggest findings!

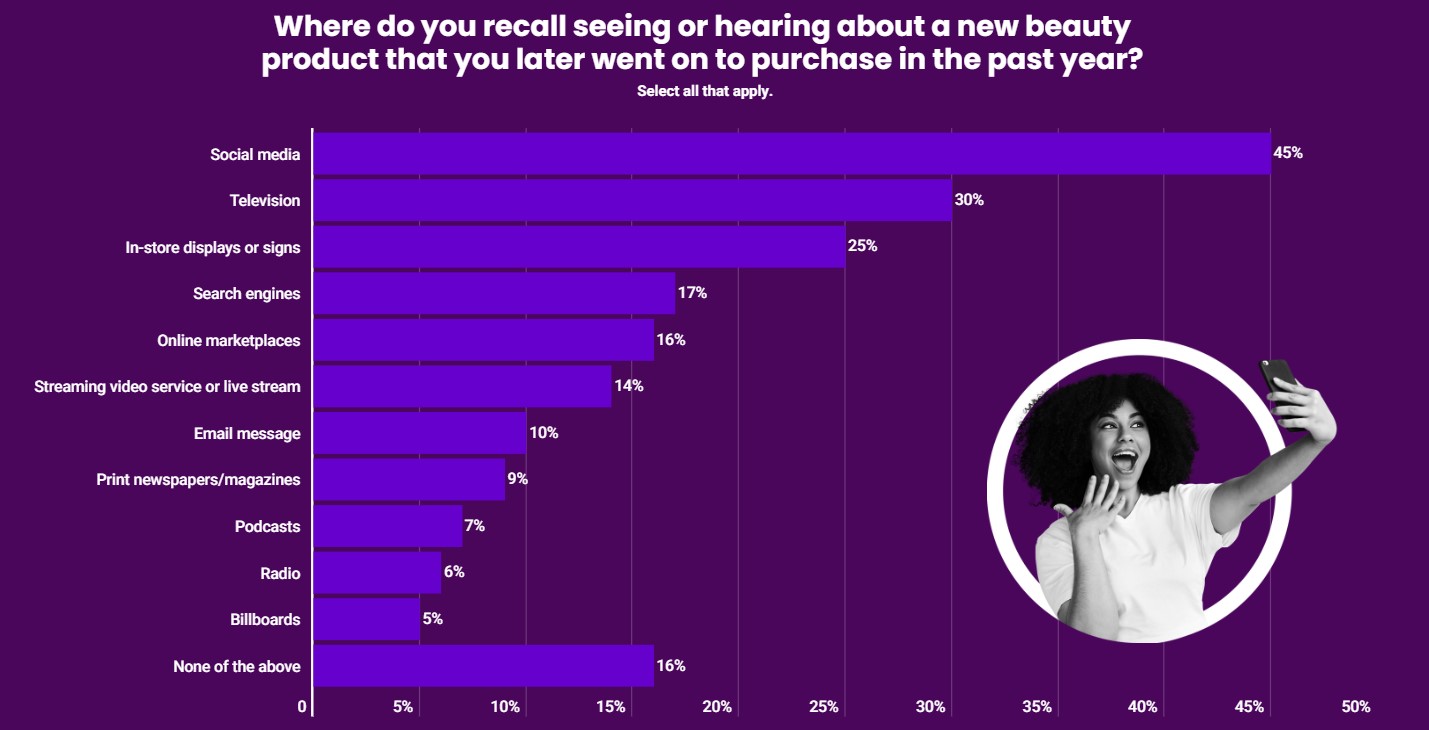

While there have been some reports of younger generations turning to TikTok in order to search for products over traditional search engines, just 2% of respondents chose social media platforms as the place they’d start a beauty product search on, and no generation saw more than 4% of its respondents select social media.

That said, social networks are hugely important to beauty product discovery, with 45% of respondents saying they recall seeing or hearing about a product through social media that they later went on to purchase in the past year, a higher share than television!

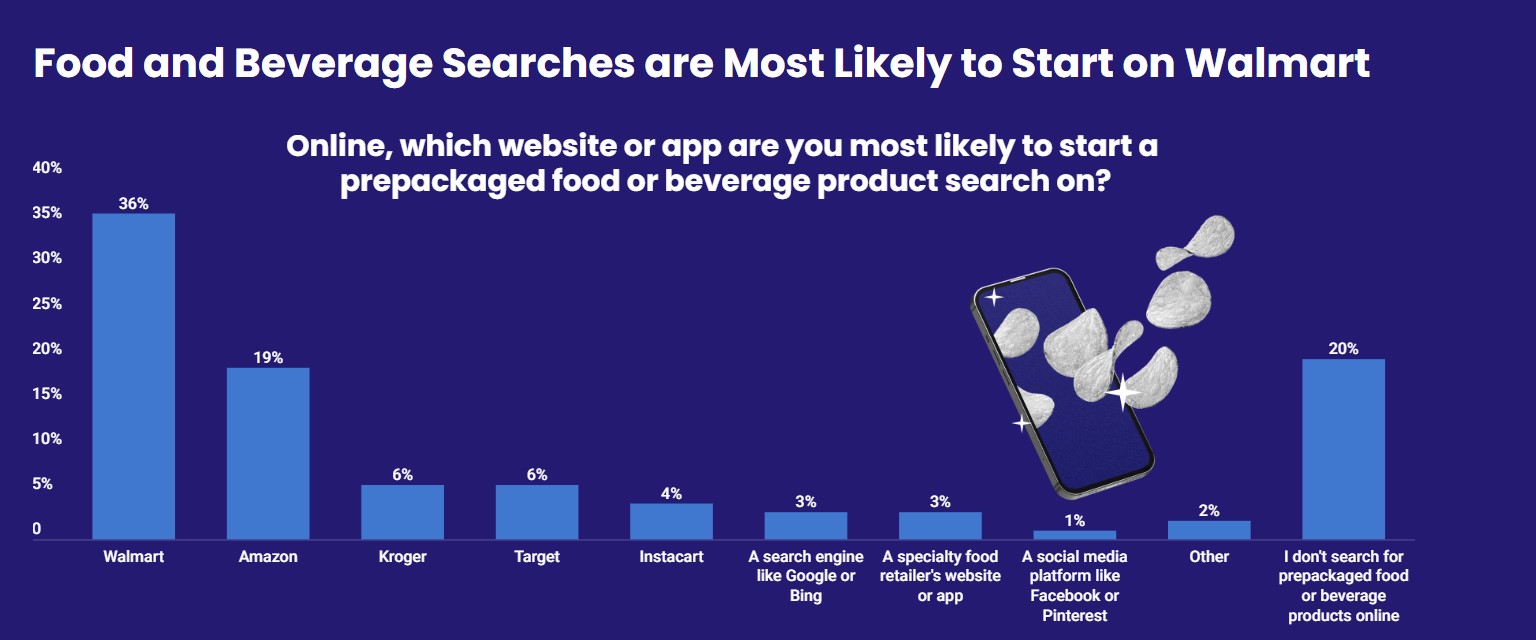

Among the 80% of shoppers who search for prepackaged food and beverage products online, Walmart is the most popular starting point, followed in a distant second by Amazon. While Amazon is a dominant force in many categories, its share of the online grocery market in particular lags its popularity for other product types.

Kroger, the largest national grocery-specific chain in the United States, accounted for the third-highest share of respondents as the website/app they’re most likely to start a food and beverage search on, with Target a close fourth. Less than 4% of respondents selected a traditional search engine like Google or Bing to start food and beverage product searches, and respondents were far more likely to head directly to websites that sold these products than search for relevant results through a search engine.

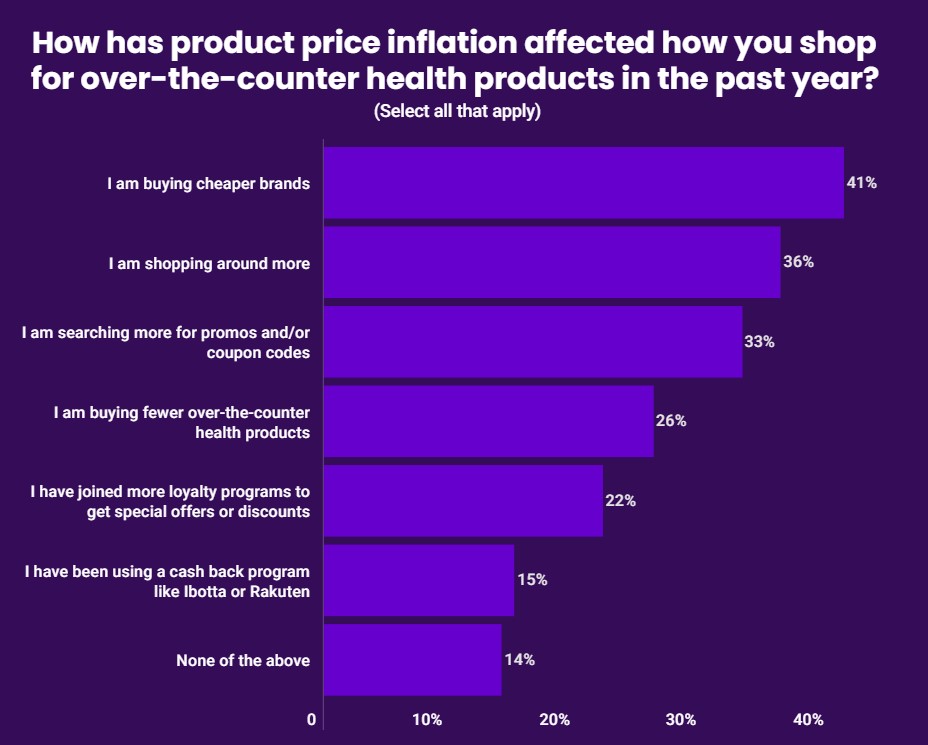

Over 40% of consumers turned to cheaper brand options for OTC health products over the past year as inflation lifted prices for US shoppers. 36% said they were shopping around more as a result of inflation, while 33% are searching for more promos and/or coupon codes.

Fully 41% of shoppers said that instant savings on certain products is the most valuable feature of any loyalty program related to OTC health purchases, while 34% said that coupons/reward points that can be redeemed for later purchases are most valuable. Given the heightened promotional sensitivity driven by inflation, businesses may be more able to drive loyalty program sign-ups today than in previous years.

This is a just a small glimpse into what our research specialist discovered. Want to learn more?